Revolutionizing Insurance Services with Geta.AI's Intelligent Solutions

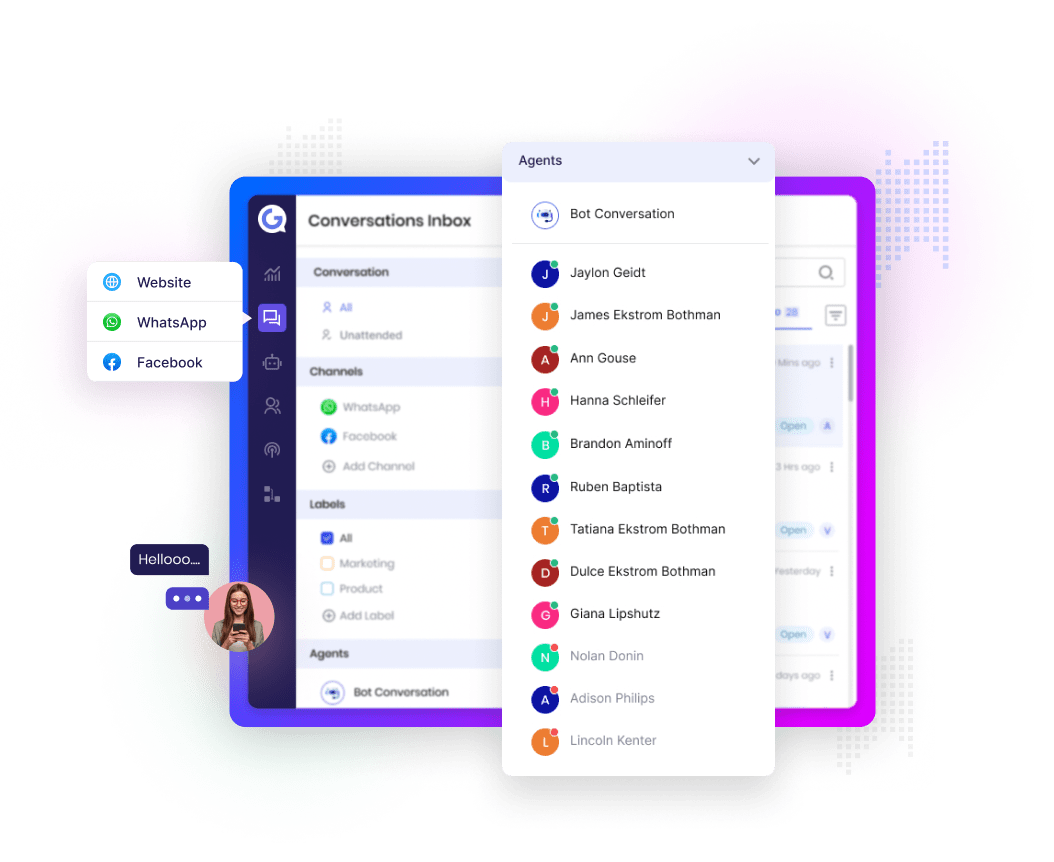

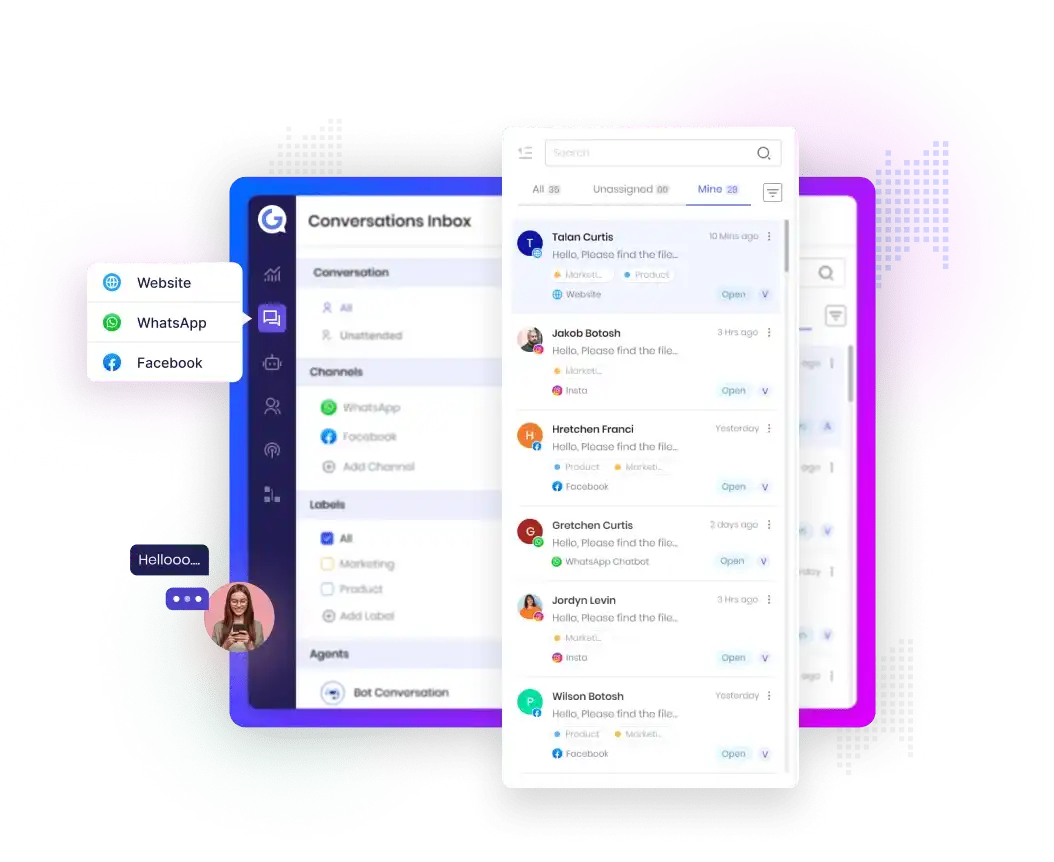

Step into the future of insurance with Geta.AI's suite of AI-powered solutions. Crafted specifically for the insurance industry, our products, including Inbox, Live Chat, Customizable AI Chatbot, Marketing Automation, Email Marketing, SMS Marketing, WhatsApp Marketing, and Customer Data Platform, are engineered to elevate customer engagement, streamline operations, and optimize marketing strategies for insurance companies.

- Streamline internal communication within insurance teams for enhanced collaboration.

- Facilitate seamless information exchange for timely decision-making and operational efficiency.

- Enable real-time communication between insurance agents, customers, and support staff.

- Enhance customer experience, provide instant assistance, and address insurance-related queries promptly.

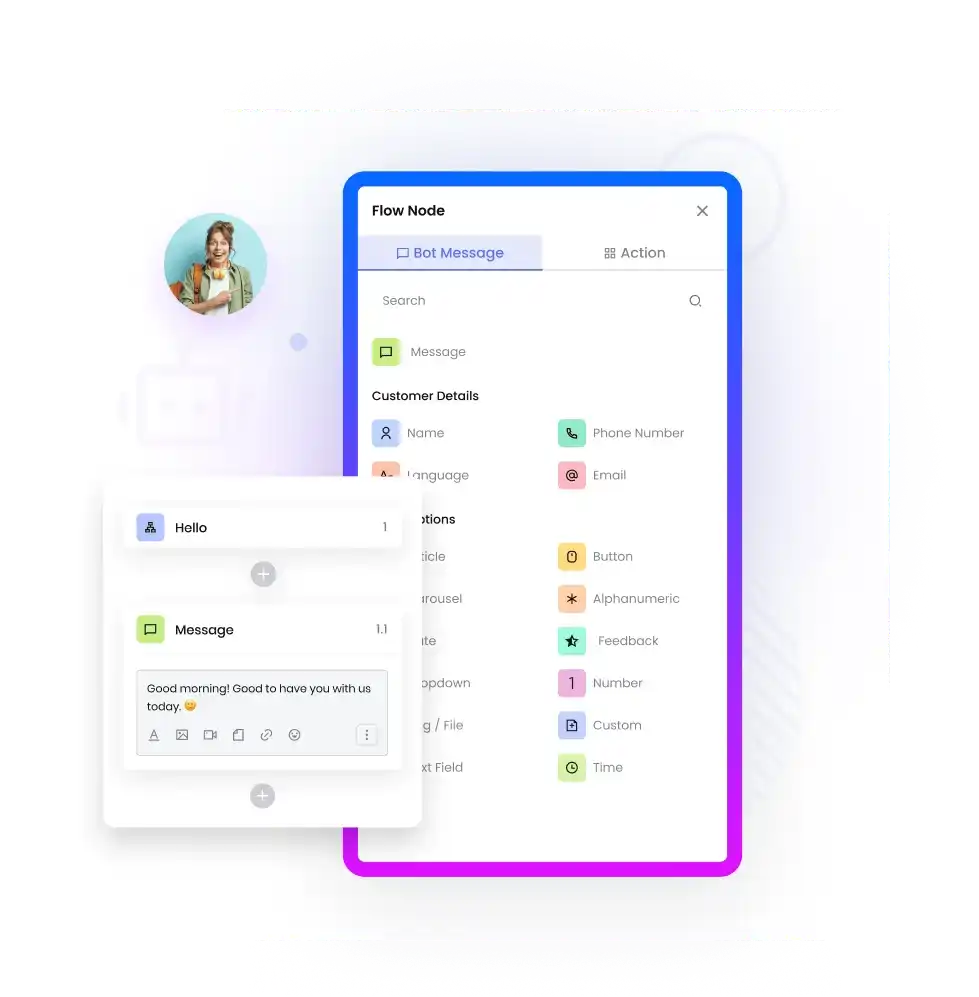

- Deploy an adaptive virtual assistant tailored to the intricate needs of the insurance industry.

- Automate responses to common queries, assist with policy inquiries, and guide customers through the insurance process.

- Build strong connections with insurance customers through personalized email campaigns.

- Share updates on policy features, risk management tips, and exclusive insurance offerings.

- Keep insurance customers informed with timely and personalized text messages.

- Send alerts for policy renewals, claim status updates, and information on new insurance products through SMS.

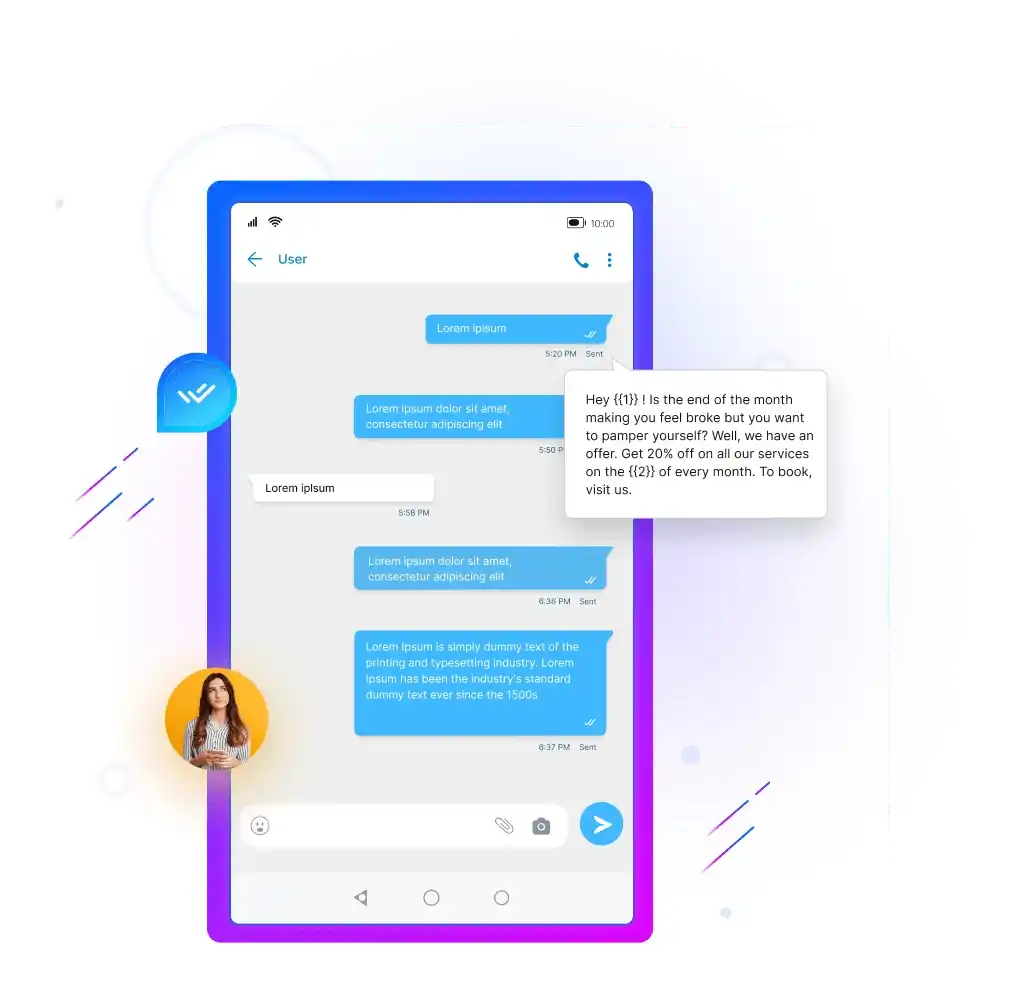

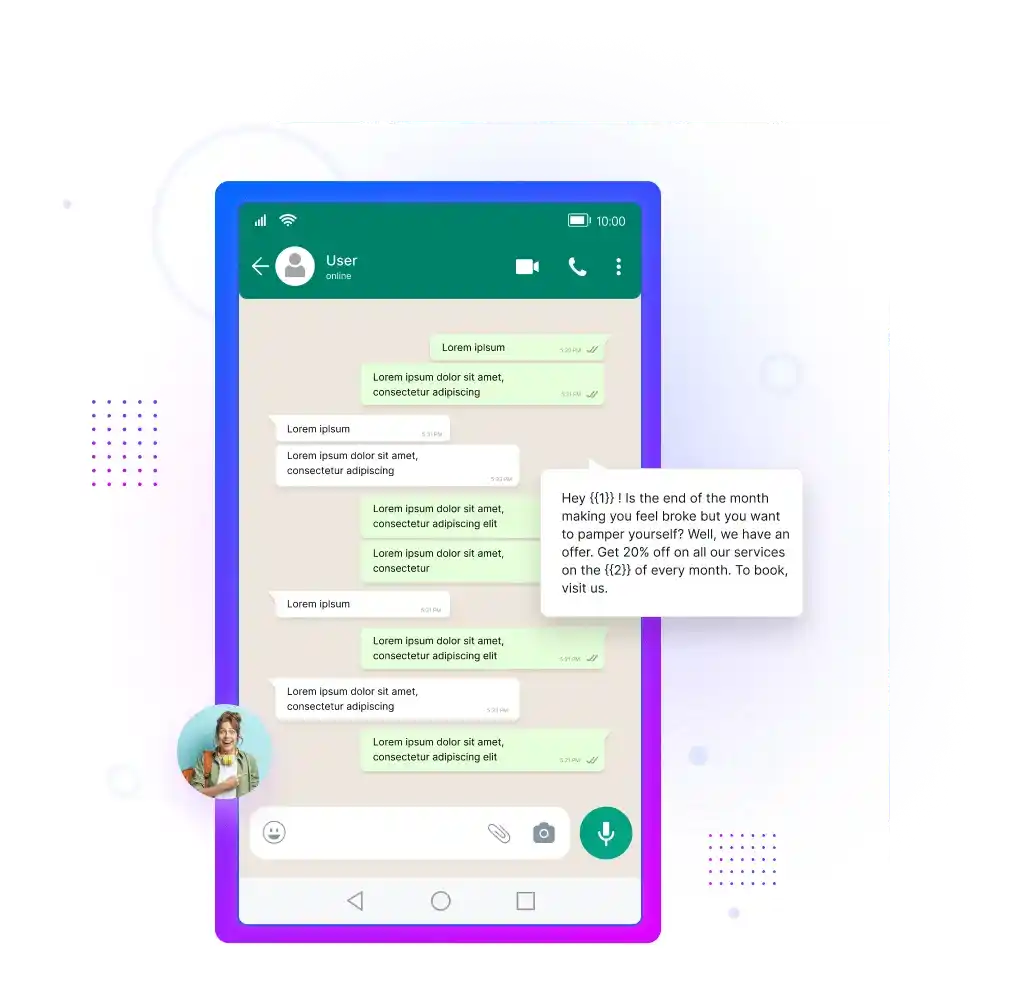

- Utilize WhatsApp for secure and personalized communication in the insurance sector.

- Share policy documents, provide claim updates, and offer a seamless channel for customer support.

- Consolidate and analyze customer data for strategic decision-making.

- Gain insights into customer preferences, claims history, and market trends for personalized insurance services.

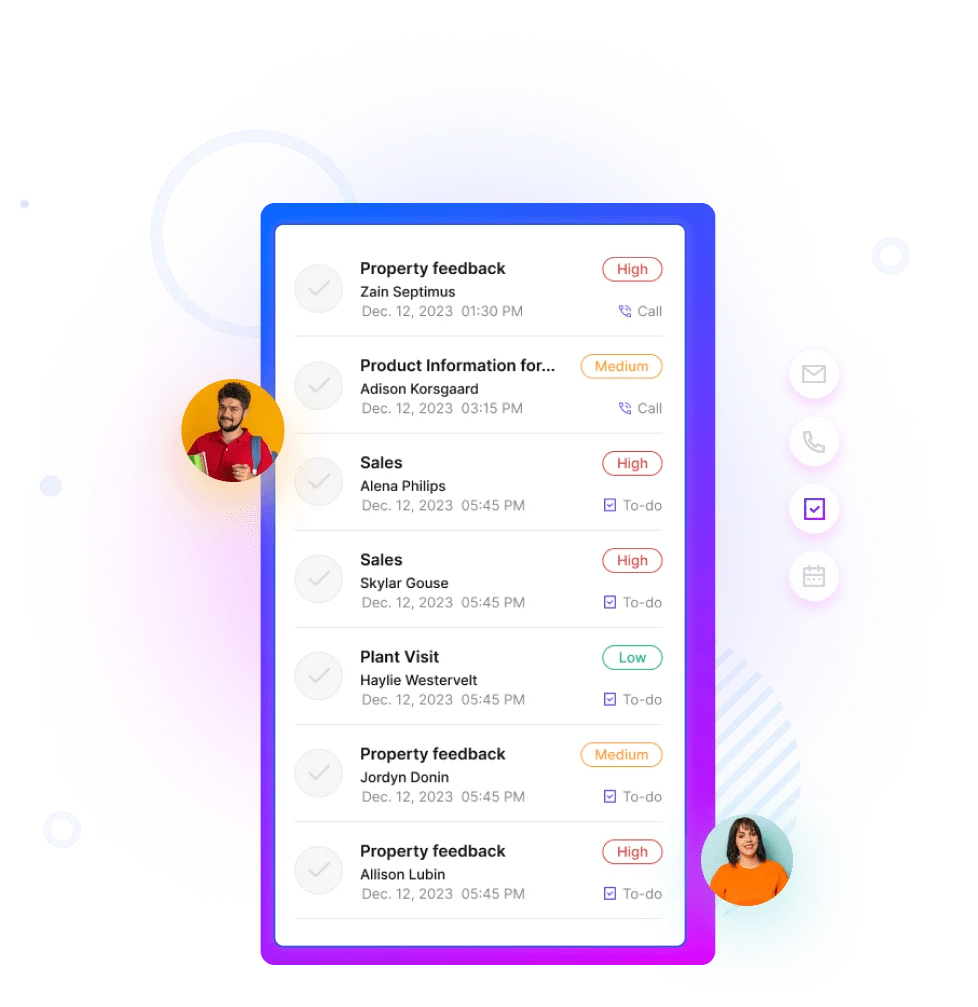

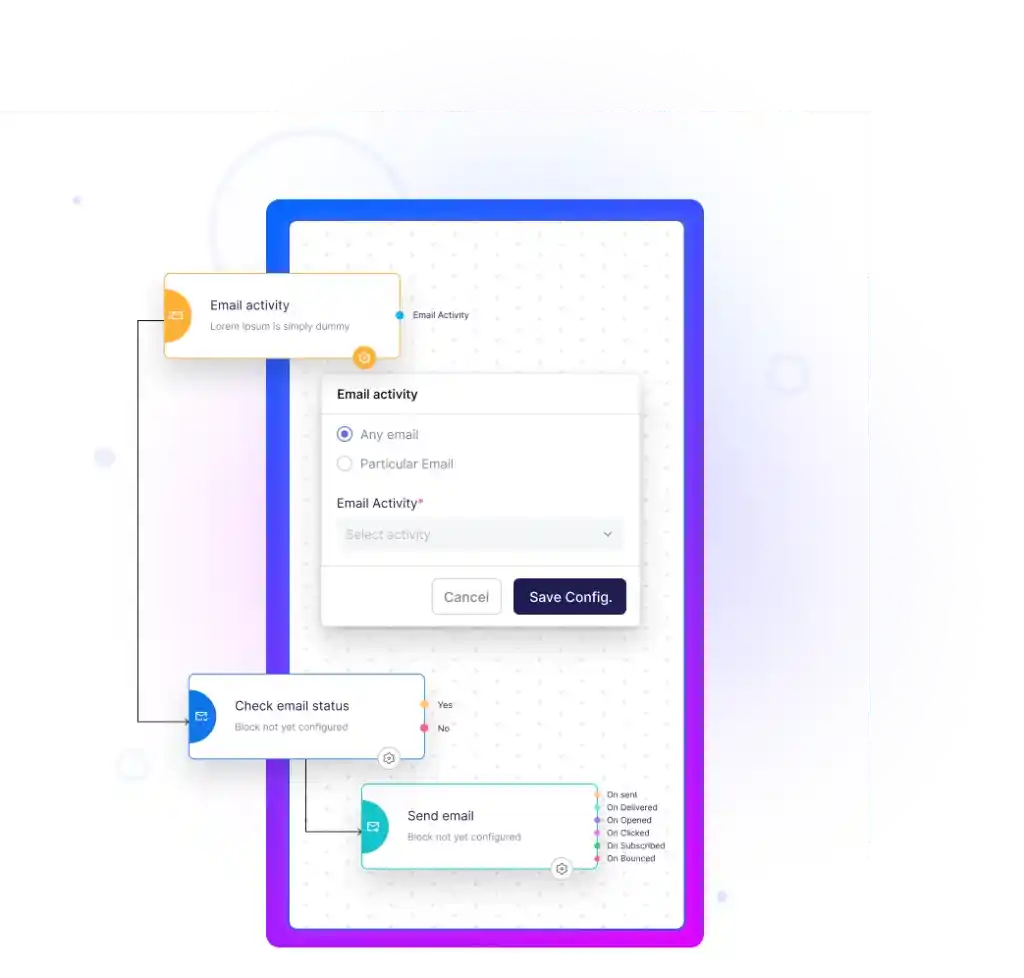

- Elevate insurance marketing efforts by automating targeted campaigns.

- Deliver personalized promotions, policy recommendations, and nurture customer loyalty for increased policy renewals.

Transform your insurance services with Geta.AI's advanced AI solutions. Elevate customer experiences, optimize operations, and stay at the forefront of innovation in the ever-evolving landscape of the insurance industry.

© 2024 GETA All Rights Reserved.